- Introduction

- Understanding Car Loans

- What is a car loan?

- How do car loans work?

- Types of Car Loans

- Secured vs. unsecured car loans

- New vs. used car loans

- Factors to Consider Before Applying

- Credit score

- Down payment

- Interest rates

- Steps to Get a Car Loan

- Check your credit score

- Research lenders

- Gather necessary documents

- Apply for pre-approval

- Compare loan offers

- Finalize the loan

- Tips for Getting Approved

- Improve your credit score

- Save for a down payment

- Consider a co-signer

- Common Mistakes to Avoid

- Ignoring your credit score

- Skipping pre-approval

- Overlooking the fine print

- Conclusion

- FAQs

| Heading | Content |

|---|---|

| Introduction | If you’re considering purchasing a car, you might need a car loan. |

| Understanding Car Loans | Learn what car loans are and how they function. |

| Types of Car Loans | Discover the different types of car loans available. |

| Factors to Consider | Understand the key factors to consider before applying for a car loan. |

| Steps to Get a Car Loan | Follow these steps to successfully obtain a car loan. |

| Tips for Getting Approved | Explore strategies to increase your chances of loan approval. |

| Common Mistakes to Avoid | Be aware of pitfalls to steer clear of during the loan process. |

| Conclusion | Summarize key points and encourage informed decision-making. |

How to Get a Loan for a Car

Introduction

If you’re in the market for a new or used car, chances are you’re considering financing options. One of the most common ways to finance a vehicle purchase is through a car loan. This article will guide you through the process of obtaining a car loan, from understanding the basics to navigating the application process successfully.

Understanding Car Loans

What is a car loan?

A car loan is a type of financing specifically designed to help individuals purchase a vehicle. It involves borrowing money from a lender, which is then repaid over time, typically in monthly installments.

How do car loans work?

Car loans work similarly to other types of loans. The borrower agrees to repay the principal amount plus interest over a set period, known as the loan term. The car itself serves as collateral, meaning the lender can repossess the vehicle if the borrower fails to make payments.

Types of Car Loans

Secured vs. unsecured car loans

Secured car loans are backed by collateral, usually the vehicle itself. Unsecured loans, on the other hand, do not require collateral but may have higher interest rates.

New vs. used car loans

New car loans are specifically for purchasing brand-new vehicles, while used car loans are for pre-owned vehicles. Interest rates and loan terms may vary depending on whether the car is new or used.

Factors to Consider Before Applying

Credit score

Your credit score plays a significant role in determining your eligibility for a car loan and the interest rate you’ll receive. A higher credit score generally results in better loan terms.

Down payment

A larger down payment can reduce the amount you need to borrow and may result in better loan terms. Aim to save up for a substantial down payment before applying for a car loan.

Interest rates

Interest rates can vary widely depending on the lender, your credit score, and the current market conditions. Shop around and compare rates from multiple lenders to find the best deal.

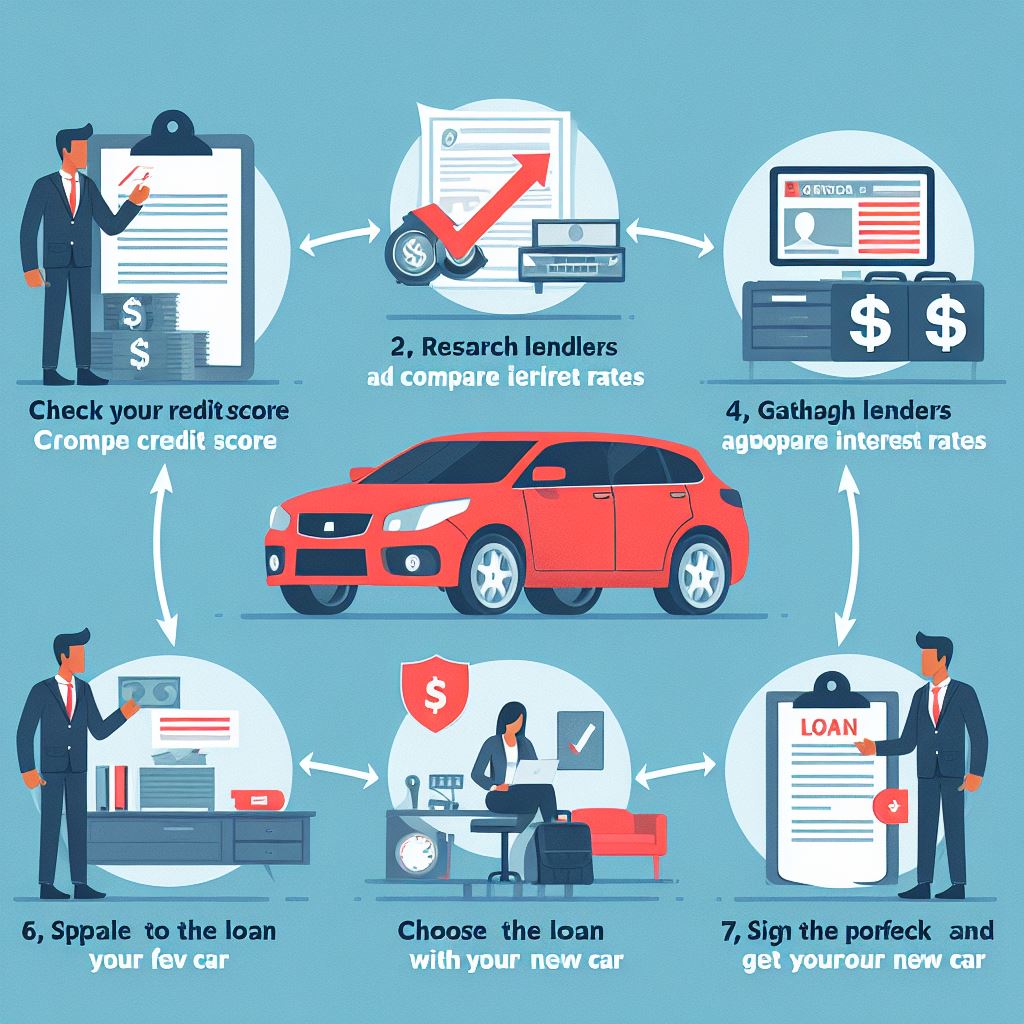

Steps to Get a Car Loan

Check your credit score

Before applying for a car loan, check your credit score and report. This will give you an idea of where you stand and whether you need to take steps to improve your credit before applying.

Research lenders

Take the time to research different lenders, including banks, credit unions, and online lenders. Compare interest rates, loan terms, and customer reviews to find the best fit for your needs.

Gather necessary documents

Before applying for a car loan, gather all the necessary documents, including proof of income, identification, and insurance information. Having everything prepared will streamline the application process.

Apply for pre-approval

Consider getting pre-approved for a car loan before shopping for a vehicle. Pre-approval can give you a clear idea of how much you can afford to spend and may make the buying process smoother.

Compare loan offers

Once you’ve been pre-approved, compare loan offers from multiple lenders to find the best terms and interest rates. Don’t forget to consider factors like fees and repayment options.

Finalize the loan

Once you’ve chosen a lender and loan offer, it’s time to finalize the loan. Review the terms and conditions carefully before signing any paperwork, and make sure you understand your obligations as a borrower.

Tips for Getting Approved

Improve your credit score

If your credit score is less than ideal, take steps to improve it before applying for a car loan. Paying down debt, making payments on time, and correcting any errors on your credit report can all help boost your score.

Save for a down payment

Saving up for a down payment can not only reduce the amount you need to borrow but also improve your chances of loan approval. Aim to save at least 10-20% of the car’s purchase price for a down payment.

Consider a co-signer

If you’re having trouble getting approved for a car loan on your own, consider asking a trusted friend or family member to co-sign the loan. Just make sure they understand the risks involved and are willing to take on that responsibility.

Common Mistakes to Avoid

Ignoring your credit score

Your credit score plays a crucial role in the car loan approval process. Ignoring it or failing to address any issues can result in higher interest rates or even loan denial.

Skipping pre-approval

Getting pre-approved for a car loan can give you a significant advantage when shopping for a vehicle. Skipping this step could mean missing out on better loan terms and potentially overpaying for your car.

Overlooking the fine print

Before signing any loan agreement, be sure to read the fine print carefully. Pay attention to details like interest rates, fees, and repayment terms to avoid any surprises down the road.

Conclusion

Obtaining a car loan doesn’t have to be complicated, but it does require careful consideration and planning. By understanding the basics of car loans, comparing offers from multiple lenders, and avoiding common pitfalls, you can secure financing for your next vehicle with confidence.

FAQs

- Can I get a car loan with bad credit?

- While it may be more challenging, it’s still possible to get a car loan with bad credit. You may need to shop around and consider alternative lenders.

- How much can I borrow with a car loan?

- The amount you can borrow will depend on various factors, including your credit score, income, and the value of the car you’re purchasing.

- What is the average interest rate for a car loan?

- Interest rates for car loans can vary widely, but the average rate is typically around 4-6% for new cars and 8-10% for used cars.

- How long does it take to get approved for a car loan?

- The approval process can vary depending on the lender and your individual circumstances. In some cases, you may receive approval within a few hours, while others may take several days.

- Can I refinance my car loan?

- Yes, it’s possible to refinance your car loan to potentially get a lower interest rate or better loan terms. However, refinancing is subject to approval from the new lender.